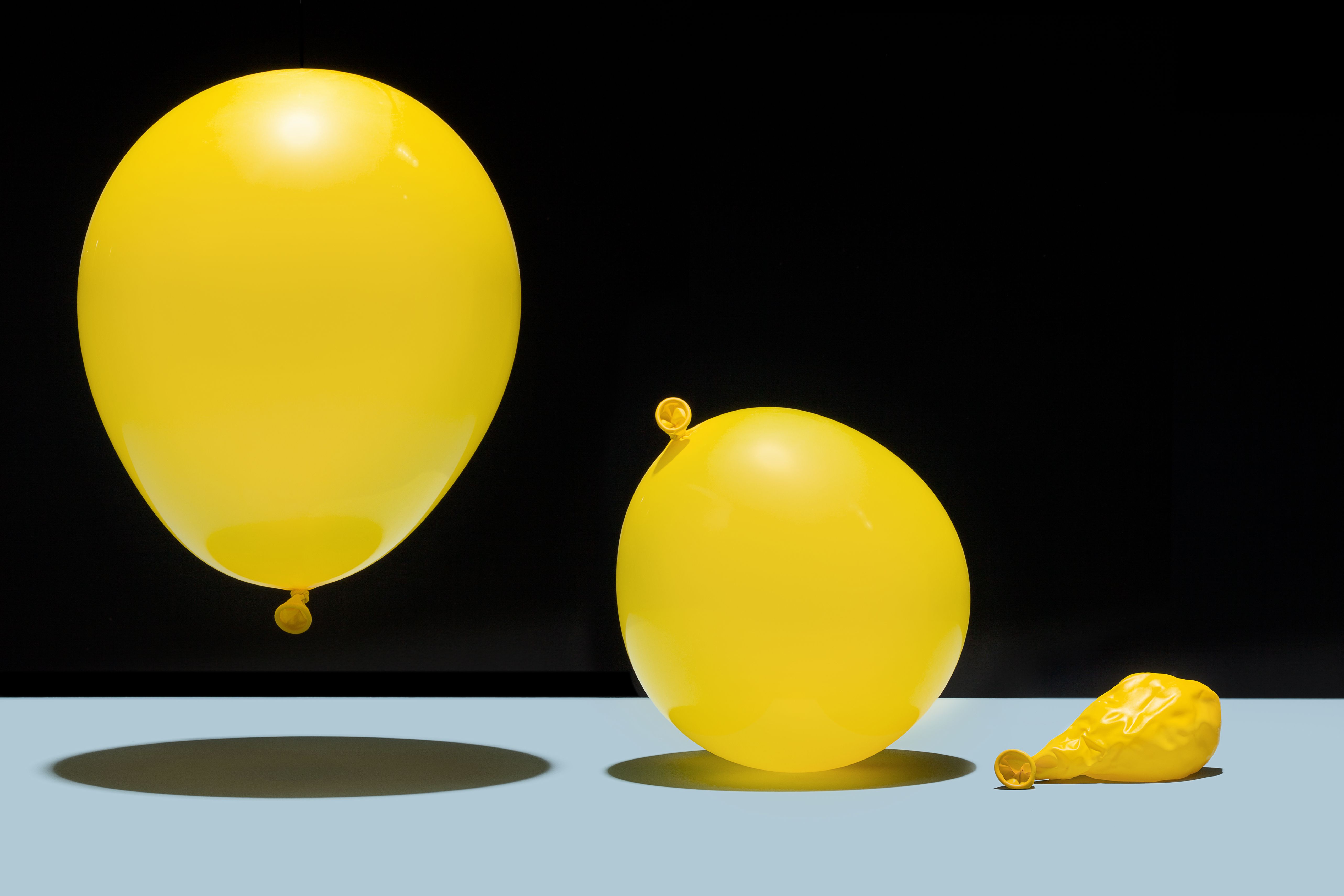

Should we worry about deflation in a Bitcoin standard world ?

A very interesting debate occurs last week between George Selgin and Saifedean Ammous about the concrete management of a deflation economy in case Bitcoin becomes the world’s monetary standard. Juice…